Portrait of pretty blonde model sitting on table.

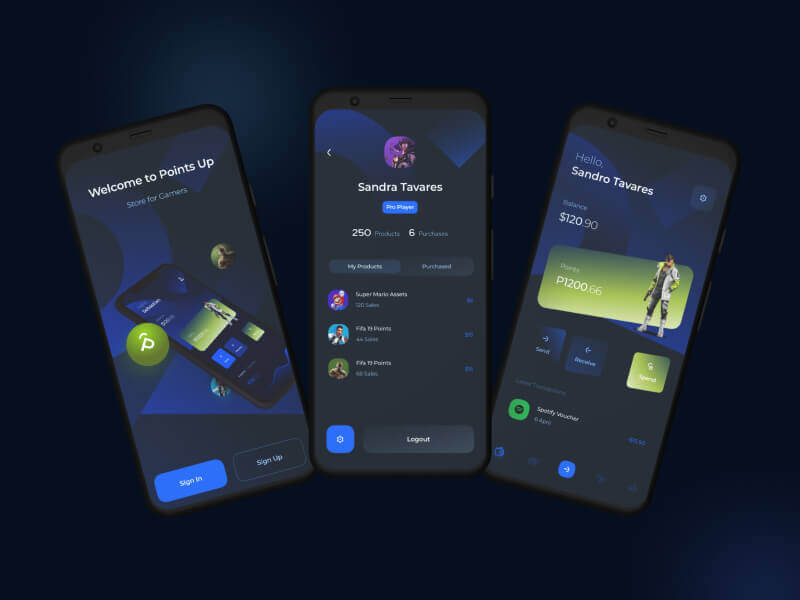

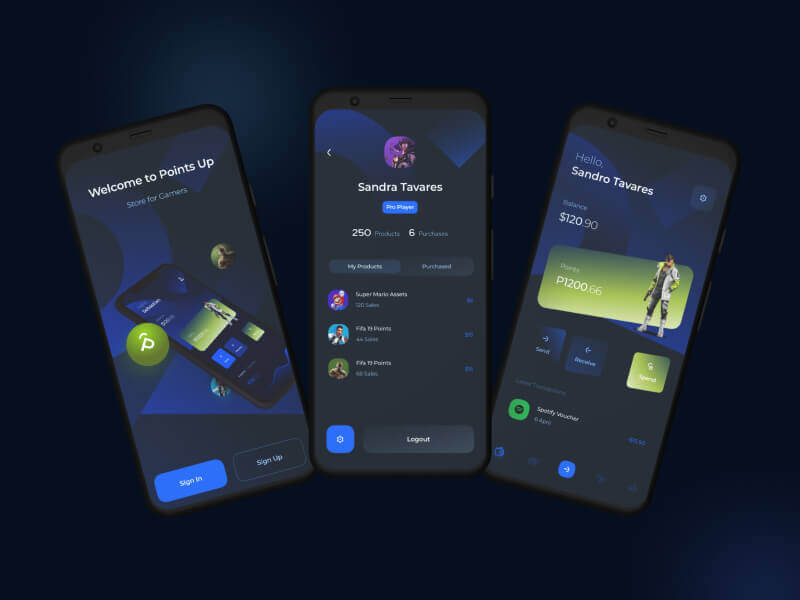

Through a wide variety of mobile applications, we’ve developed a unique visual system and strategy that can be applied across the spectrum of available applications.

Through a wide variety of mobile applications, we’ve developed a unique visual system and strategy that can be applied across the spectrum of available applications.

So, just like identifying stocks with growth potential, pinpointing toxic stocks and offloading them at the right time is crucial to guard one’s portfolio from big losses or make profits by short selling them.

Heska Corporation HSKA, Tandem Diabetes Care, Inc. TNDM, Credit Suisse Group CS,Zalando SE ZLNDY and Las Vegas Sands LVS are a few such toxic stocks.Screening Criteria

Through a wide variety of mobile applications, we’ve developed a unique visual system and strategy that can be applied across the spectrum of available applications.

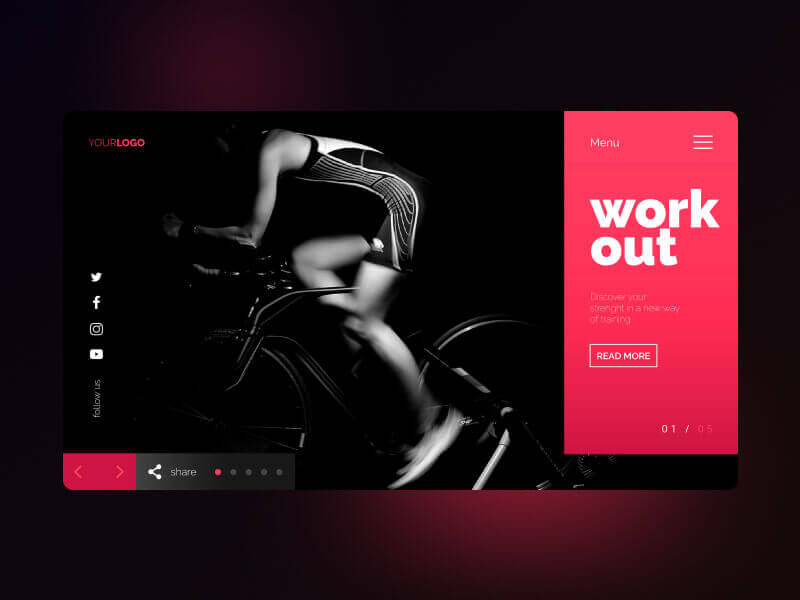

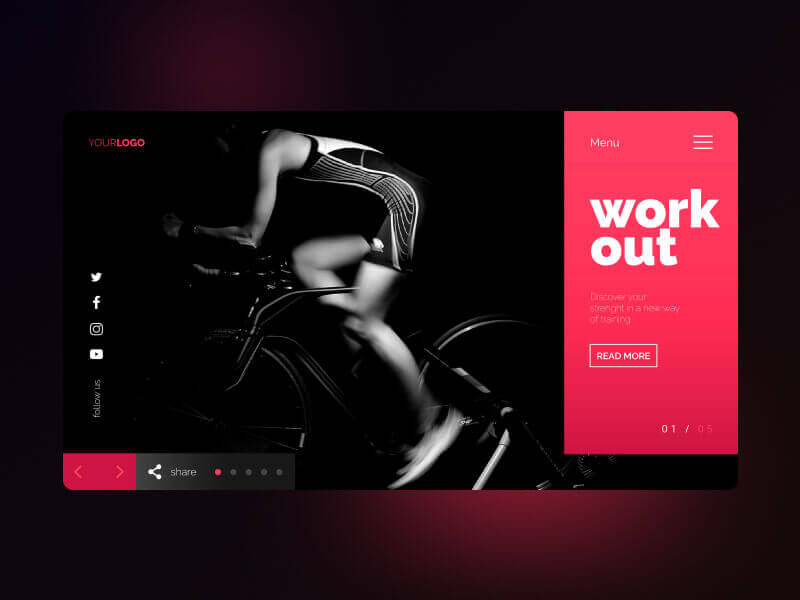

A strategy is a general plan to achieve one or more long-term.

UI/UX Design, Art Direction, A design is a plan or specification for art.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Quis ipsum suspendisse ultrices gravida. Risus commod viverra maecenas accumsan lacus vel facilisis. ut labore et dolore magna aliqua.

There are always some stocks, which illusively scale lofty heights in a given time period. However, the good show doesn’t last for these overblown toxic stocks as their current price is not justified by their fundamental strength.

Toxic companies are usually characterized by huge debt loads and are vulnerable to external shocks. Accurately identifying such bloated stocks and getting rid of them at the right time can protect your portfolio.

Overpricing of these toxic stocks can be attributed to either an irrational enthusiasm surrounding them or some serious fundamental drawbacks. If you own such bubble stocks for an inordinate period of time, you are bound to see a massive erosion of wealth.

However, if you can precisely spot such toxic stocks, you may gain by resorting to an investing strategy called short selling. This strategy allows one to sell a stock first and then buy it when the price falls.

While short selling excels in bear markets, it typically loses money in bull markets.

So, just like identifying stocks with growth potential, pinpointing toxic stocks and offloading them at the right time is crucial to guard one’s portfolio from big losses or make profits by short selling them. Heska Corporation HSKA, Tandem Diabetes Care, Inc. TNDM, Credit Suisse Group CS,Zalando SE ZLNDY and Las Vegas Sands LVS are a few such toxic stocks.Screening Criteria

Through a wide variety of mobile applications, we’ve developed a unique visual system and strategy that can be applied across the spectrum of available applications.

A strategy is a general plan to achieve one or more long-term.

UI/UX Design, Art Direction, A design is a plan or specification for art.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Quis ipsum suspendisse ultrices gravida. Risus commod viverra maecenas accumsan lacus vel facilisis. ut labore et dolore magna aliqua.

There are always some stocks, which illusively scale lofty heights in a given time period. However, the good show doesn’t last for these overblown toxic stocks as their current price is not justified by their fundamental strength.

Toxic companies are usually characterized by huge debt loads and are vulnerable to external shocks. Accurately identifying such bloated stocks and getting rid of them at the right time can protect your portfolio.

Overpricing of these toxic stocks can be attributed to either an irrational enthusiasm surrounding them or some serious fundamental drawbacks. If you own such bubble stocks for an inordinate period of time, you are bound to see a massive erosion of wealth.

However, if you can precisely spot such toxic stocks, you may gain by resorting to an investing strategy called short selling. This strategy allows one to sell a stock first and then buy it when the price falls.

While short selling excels in bear markets, it typically loses money in bull markets.

So, just like identifying stocks with growth potential, pinpointing toxic stocks and offloading them at the right time is crucial to guard one’s portfolio from big losses or make profits by short selling them. Heska Corporation HSKA, Tandem Diabetes Care, Inc. TNDM, Credit Suisse Group CS,Zalando SE ZLNDY and Las Vegas Sands LVS are a few such toxic stocks.Screening Criteria

Through a wide variety of mobile applications, we’ve developed a unique visual system and strategy that can be applied across the spectrum of available applications.

The QubIt Fulfillment Platform is an end-to-end software and automation solution designed to support omnichannel retail operations, particularly in the grocery and fast-moving consumer goods sectors. It enables retailers to manage multi-site fulfillment centers through a unified platform integrated with retail IT systems. The project aimed to simplify operations, improve delivery speed, and enhance profitability by bringing fulfillment closer to the consumer.

In the strategy phase, the focus was on aligning the QubIt platform with the operational needs of grocery retailers. The goal was to create a scalable and flexible infrastructure that could support multiple fulfillment centers across different regions. You contributed to defining the cloud strategy, selecting Azure and AWS as the core platforms, and establishing DevOps practices to support continuous delivery and infrastructure automation. Security, compliance, and cost optimization were also key strategic priorities, ensuring the platform could scale securely and efficiently.

During the design phase, you collaborated with platform engineers, developers, and product managers to architect a cloud-native infrastructure. You designed the CI/CD pipelines to support automated software delivery, integrated version control systems, and implemented infrastructure as code using Terraform. The platform was containerized using Docker and orchestrated with Kubernetes, enabling modular deployments and streamlined updates. Observability was built into the design using Prometheus, Grafana, and Azure Monitoring, ensuring real-time visibility into system performance and health. Security controls and policies were embedded into the infrastructure design to meet industry standards and client requirements.

In the implementation phase, you led the provisioning and configuration of cloud infrastructure, implemented CI/CD pipelines, and deployed containerized applications across multiple environments. You worked closely with stream-aligned teams to ensure each team managed its own pipelines, promoting autonomy and faster delivery cycles. You also set up observability tools, configured alerts and dashboards, and implemented autoscaling policies to ensure performance and reliability. Security best practices were enforced through regular assessments and automated compliance checks. Additionally, you supported 24/7 operations by developing incident response plans and participating in on-call rotations.

As a Senior DevOps Engineer and Cloud Solution Architect, you were responsible for the end-to-end infrastructure lifecycle—from planning and design to deployment and operations. Your work enabled the QubIt platform to operate seamlessly across multiple fulfillment centers, supporting high-volume, time-sensitive grocery operations. The project scope included infrastructure automation, CI/CD pipeline management, container orchestration, observability, security, and performance optimization.

Add this content: Give me the Page name I will add the content